The family put all their assets into buying Bitcoin 3

In 2017, this family of 5 in the Netherlands sold all their assets, from a profitable business to a house larger than 230 square meters and even their shoes, to buy Bitcoin and begin a life of traveling around the world.

`We got into Bitcoin because we wanted to change our lives,` said the 42-year-old father.

When Bitcoin prices plummeted in 2018, Taihuttu bought more.

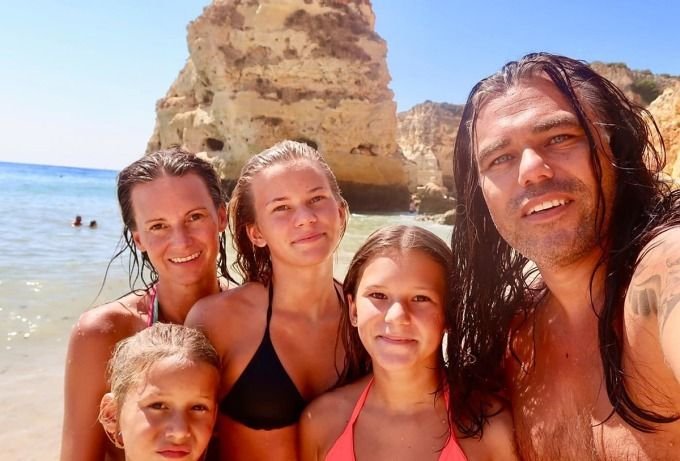

Didi Taihuttu family on a trip.

Earlier this week, Bitcoin price reached an all-time high, with 19,920 USD per coin.

Mike Novogratz – CEO of investment company Galaxy Digital believes that this upward momentum has just begun.

Taihuttu bought most of the current Bitcoin in early 2017, when the price was $900.

When asked if he was worried that this surge was another bubble, Taihuttu said: `I don’t see demand decreasing. I think we are still moving towards a supply crisis.`

Many experts also share this opinion with him.

`The increase in 2017 was mainly due to individual investors. This year is the participation of organizations and investment fund directors,` said Mati Greenspan – Portfolio Manager at Quantum Economics.

“When PayPal starts selling Bitcoin to its 350 million users, they will need to buy Bitcoin somewhere,” Taihuttu said.

Demand from institutional investors also doesn’t seem to be slowing down.

Mike Bucella at BlockTower Capital said in an interview with CNBC that new individual investors are the ones missing out on Bitcoin’s rally this year.

Of course, not all individual investors miss out.

2020 may be different from 2017, but Bitcoin is also an asset class, and will fluctuate cyclically.

However, for Taihuttu, the Bitcoin game is not entirely about making profits.